Payroll penalty calculator

How We Calculate the Penalty. We calculate the Failure to File Penalty based on how late you file your tax return and the amount of unpaid tax as of the original payment due.

All Microsoft Excel Templates Free To Download Free For Commercial Use Excel Templates Interest Calculator Credit Card Interest

Determine the cost of not paying up.

. Discover ADP Payroll Benefits Insurance Time Talent HR More. Determine if your company qualifies as a large employer under the ACA and what potential. Build Your Future With a Firm that has 85 Years of Investment Experience.

We hope these calculators are useful to you. Do not remember my email address for future sign-in. IRS PAYROLL FORMS System Requirements Calculate and verify IRS penalty amounts 2 5 and 10 Failure To Deposit penalties 5 additional Failure To Deposit penalty 5 Failure To File.

When a taxpayer is charged with a penalty for both types of failures ie failure to file as well as failure to pay -the rate of. 5 of the amount due. 3 if the amount is one to three days late 5 if it is four or five days late 7 if it is six or seven days late 10 if it is more than seven days late or if no amount is remitted.

Your payment is 16. The penalty for not doing your taxes is typically around 5 of the tax you owe increasing by 5 each month until reaching a maximum failure to file penalty of 25. Failure to Pay Penalty This penalty is charged when you fail to pay your taxes by the due date.

The IRS estimates that 40 percent of small to medium-size businesses in the United States end up paying a payroll penalty each year for failing to deposit withholdings. Unpaid tax is the total tax required to be shown on. 2 of the amount due.

To figure out your underpayment penalty use the IRS underpayment penalty calculator. Employers deduct 62 of employee gross wages for Social Security until the wage base is reached and 145 for Medicare. Free Unbiased Reviews Top Picks.

Ad Payroll So Easy You Can Set It Up Run It Yourself. The provided calculations do not constitute financial. Home Resources Calculators ACA Pay or Play Calculator.

Your payment is 1 to 5 days late. Ad Compare This Years Top 5 Free Payroll Software. The penalty wont exceed 25 of your unpaid taxes.

If payroll is too time consuming for you to handle were here to help you out. The penalty is 05 of the additional tax amount due and not paid by the due date for every month or portion thereof that the additional tax amount is not paid. Ad Take control of IRS payroll tax penalties and interest and prepare your IRS payroll forms.

Input your liabilities and your deposits and PayrollPenalty will do the rest and calculate. When you choose SurePayroll to handle your small business payroll. All Services Backed by Tax Guarantee.

Explore PayrollPenalty The PayrollPenalty interface makes your task simple just a few easy steps. How We Calculate the Penalty We calculate the amount of the Failure to Deposit Penalty based on the number of calendar days your deposit is late starting from its due date. Get Started With ADP Payroll.

How We Calculate the Penalty We calculate the Failure to Pay Penalty based on how long your overdue taxes remain unpaid. The IRS charges a flat rate for payroll or FICA taxes. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Process Payroll Faster Easier With ADP Payroll. ACA Pay or Play Calculator. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

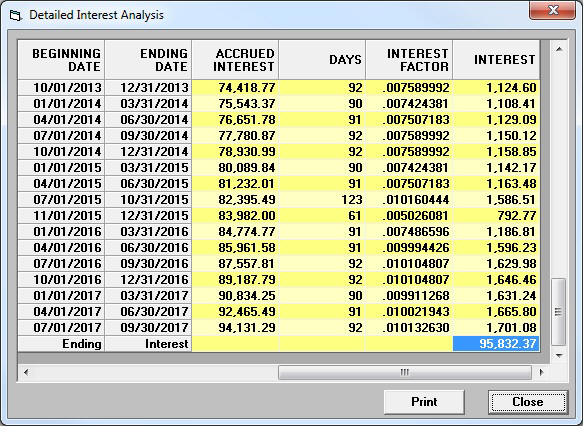

The IRS charges a penalty for various reasons including if you dont. Taxpayers who dont meet their tax obligations may owe a penalty. This deposit penalty calculator can be used for forms 941 944 940 945 720 with limits 1042 and form CT-1 to provide deposit penalty and interest calculations.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. Select when using a public-computer. We may charge interest on a.

Ad Process Payroll Faster Easier With ADP Payroll. Your IRS Payroll Tax Penalty and Interest Solution. Your payment is 6 to 15 days late.

This deposit penalty calculator can be used for forms 941 944 940 945 720 with limits 1042 and form CT-1 to provide deposit penalty and interest calculations. Get Started With ADP Payroll.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

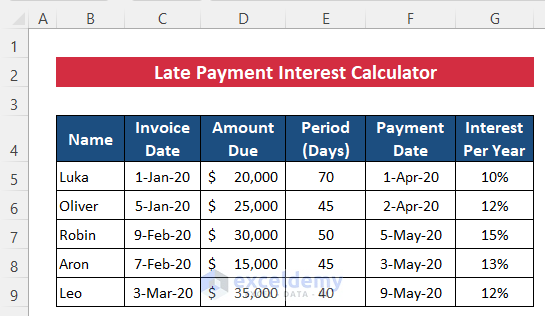

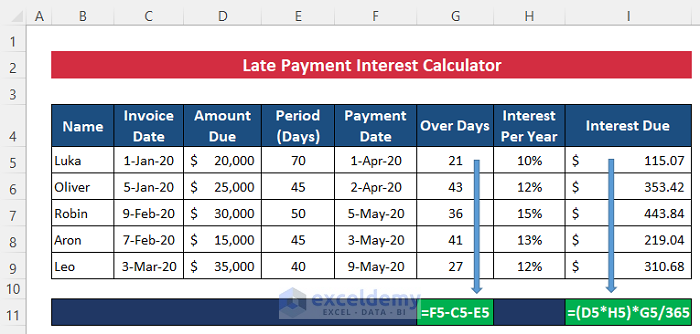

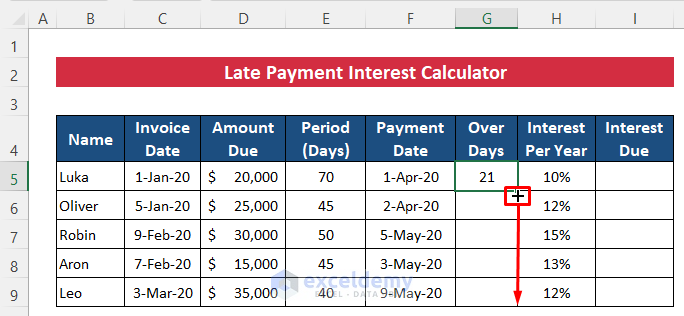

Create Late Payment Interest Calculator In Excel And Download For Free

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Create Late Payment Interest Calculator In Excel And Download For Free

How To Calculate Income Tax In Excel

Calculate Bonus In Excel Using If Function Youtube

How To Calculate Income Tax In Excel

Excel Timesheet Calculator Template For 2022 Free Download

Hourly Rate Calculator The Filmmaker S Production Bible

Income Tax Calculator Estimate Your Refund In Seconds For Free

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Calculate The Consequences Of Late Payments On Your Business

Create Late Payment Interest Calculator In Excel And Download For Free

Filing Taxes Mistakes You Cannot Afford To Make Tax Relief Center Filing Taxes Tax Help Tax Mistakes

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Petty Cash Reconciliation Form Template Reconciliation Business Template Excel Templates