25+ Nj Take Home Pay Calculator

Salary Paycheck Calculator New Jersey Paycheck Calculator Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried. New Jersey Income Tax Calculator 2021 If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

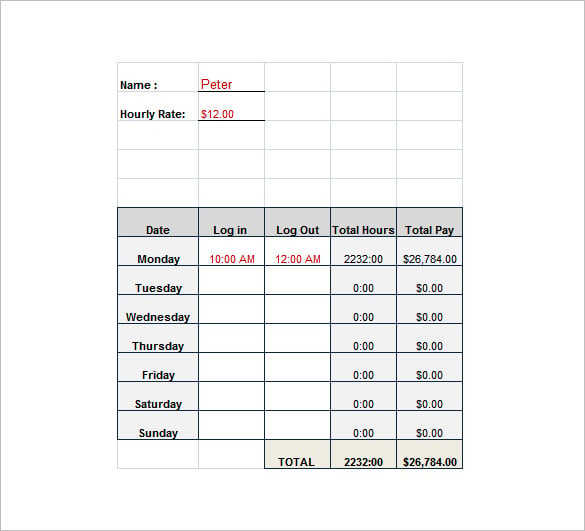

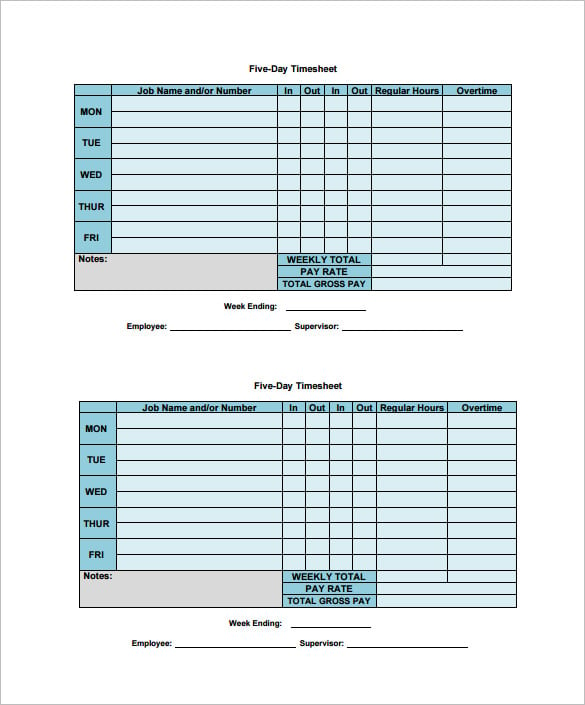

8 Salary Paycheck Calculator Doc Excel Pdf

Easy 247 Online Access.

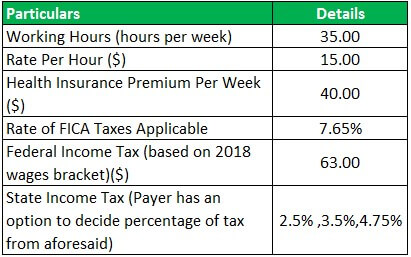

. It can also be used to help fill. If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2000 and other dependents by 500. Both employers and employees contribute.

Open an Account Earn 14x the National Average. No monthly service fees. If you make 170000 in New Jersey what will your salary after tax be.

Total tax - 10434 Net pay 44566 Marginal tax rate 326 Average tax rate 190 810 Net pay 190 Total tax People also ask 55000 yearly is how much per hour. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Simply enter their federal and state W-4 information.

Supports hourly salary income and multiple pay frequencies. Use this calculator to help you determine your paycheck for hourly wages. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

First enter your current payroll information and deductions. Our income tax and paycheck calculator can help you understand your take home pay. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in New Jersey.

The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and. Add up the total. Heres how to calculate it.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. If youre a new employer youll pay a flat rate of 28.

For example if an employee earns 1500 per week the individuals. Rates range from 05 to 58 on the first 39800 for 2022. Your average tax rate is 1198 and your marginal tax.

New Jersey Paycheck Calculator Smartasset

3 5 Garden Street Ringwood Vic 3134 Domain

25 Seaview Dr Egg Harbor Township Nj 08403 Mls 445348 Redfin

New Jersey Paycheck Calculator Smartasset

25 Navajo Court Unit 25 Galloway Township Nj 08205 Compass

Free Paycheck Calculator Hourly Salary Usa Dremployee

107 N Delavan Ave Margate Nj 08402 Realtor Com

Free Payroll Tax Paycheck Calculator Youtube

25 West Groveland Avenue Somers Point Nj 08244 Compass

Net Income Formula Calculator With Excel Template

8 Greenwich Dr Unit 8 Galloway Township Nj 08205 Realtor Com

Office Hewlettpackard 1b Business Calculator With Case Work School Office Home Math Poshmark

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Nurse Salaries Which Us States Pay Rns The Best 2022 Updated

New Jersey Income Tax Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Take Home Pay Definition Example How To Calculate